National Food Crime Unit (NFCU) - Annual Update

FSA 23-12-11 This Board paper reviews the NFCU's operational delivery for the 2023 calendar year, governance arrangements, future challenges and opportunities.

1. Summary

1.1 The Board is invited to:

- Review the NFCU's operational delivery for the 2023 calendar year.

- Note the progress made on the external review findings and the Industry Food Fraud Working Group objectives.

- Review the NFCU's governance arrangements and principles governing adoption or continuation of investigative activity.

- Note the NFCU's future challenges and opportunities.

- Agree the NFCU's proposed priorities for the upcoming year.

2. Introduction

2.1 NFCU investigations are progressing towards judicial outcomes. Four trial dates are confirmed in 2024, linked to three investigations. Another case awaits charging decisions from the Crown Prosecution Service (CPS).

2.2 Good progress has been made in implementing the five recommendations of the 2022 external review. Thirty-one actions relating to identified Areas For Improvement (AFIs) from the review have been integrated into current and future activity.

2.3 In response to the review, the NFCU has established a new Mission Statement and Key Performance Indicators (KPIs). The KPIs aim to quantify the NFCU's recorded impact against food crime and how our understanding of the food crime threat has improved.

2.4 The NFCU is making good progress towards securing additional powers and is on track to lay two statutory instruments in early 2024. This will enable the NFCU to issue warrants, evidence seizures and independently interview suspects. It will also ensure that the appropriate oversight is applied to their use. The powers will mean food crime officers can conduct investigations more effectively, with pace, more independence and appropriate scrutiny.

2.5 Experiences linked to Operation HAWK and associated media interest led to improvements in process and practices. It invigorated partner engagement, renewing recognition of shared responsibilities around food crime.

2.6 We are working collaboratively across the FSA and beyond, contributing to the FSA's aim of being more evidence and intelligence-led. We are supporting this through our work as a core member of intelligence coordination processes and providing input into the determination of surveillance sampling priorities. The NFCU is also contributing to a centralised FSA review of horizon scanning.

3. Operational Delivery in 2023

3.1 The review of the NFCU's Control Strategy for 23/24 enhanced the FSA's insight into food crime threats. The agreed priorities were:

- criminality in the red meat sector with a focus on beef, pork and lamb supply chains.

- fraudulent activity within the chicken sector.

- the diversion of meat and poultry animal by-products (ABP) back into the food and feed chain.

- the entry of illegally harvested or misrepresented shellfish into the human food chain.

- dangerous non-foods sold for consumption to UK consumers.

- fraud relating to sustainable products and claims.

The main change to NFCU priorities in 2023-24 is the inclusion of chicken (based on intelligence and on insight from NFCU investigations).

3.2 Three cross-cutting themes which intersect with some of these priority areas were also retained within as part of the strategy, namely:

- threats manifesting in food service supply chains and establishments.

- the illicit servicing of community demand being met through unlawful processing and imports.

- offending linked to or facilitated by intermediaries within supply chains.

3.3 The NFCU continues to apply the Home Office '4P' (footnote 1) plan to deliver a holistic response to food crime.

3.4 Within the Pursue strand, the NFCU is progressing investigations towards judicial outcomes. Four cases await trial. Two concern the illegal diversion of animal by-product into the human food chain. A third concerns European distribution fraud involving the theft of food items with an estimated value of £520,000. The final case concerns the obstruction of an NFCU officer attempting to conduct an unannounced inspection. Annex A provides further details on these investigations.

3.5 The NFCU has capacity to progress up to ten investigations and develop around 20 strands of intelligence at any given time. Several other investigations are being progressed and include ‘smokies,’ the misrepresentation of premium brand potatoes, misrepresentation of salmon and the misrepresentation of housed chicken as free-range. The latter investigation prompted the release of the first Food Fraud Alert issued following revisions to alert processes. This was shared with industry partners and local authorities. The process was amended following work with the Food Fraud Industry Working Group, referenced later in this report.

3.6 The NFCU also coordinated activity across the three nations targeting fake and substandard food and drink under the Europol initiative, Operation OPSON.

2,4-Dinitrophenol (DNP)

3.7 The NFCU continued to take steps against the significant threat posed by DNP (footnote 2). Current data identifies 34 known deaths linked to DNP toxicity in the UK since 2007. One fatality occurred in 2023. Noteworthy outcomes included:

- a 33-month sentence for a seller in the United States, following NFCU coordination of UK police and the US Food and Drug Administration.

- rapid operational action undertaken against the DNP threat, after receiving intelligence indicating that six separate DNP packages had entered the UK through different airports and begun their journey to recipients. The Investigations team visited each purchaser and advised on the dangers of DNP. All recovered products were seized and destroyed.

- a reduction in online access to DNP as a result of websites being taken down. DNP website takedowns have accounted for 29% of all disruptions recorded by the NFCU so far in 2023 (see Annex B).

3.8 Of the 12 DNP operations (footnote 3) live during 2023, one was unable to be progressed to a prosecution. This was due to the prosecuting authority being unable to raise charges within the necessary timescale.

3.9 As of 1 October 2023, DNP was classified as a poison under the Poisons Act 1972. The police now hold responsibility for offences relating to DNP. The NFCU is ensuring a smooth transition of responsibility to the police for investigating these matters.

Financial investigation

3.10 The NFCU's Accredited Financial Investigators continue to support tasked investigations and intelligence development. During 2023, NFCU officers have:

- secured six Production Orders from Crown Court Judges, in progression of money laundering enquiries.

- obtained three Restraint Orders, preventing suspects from disposing of identified assets until their trial is finalised, making it more likely assets remain available for later confiscation.

- established a panel to manage funds acquired via the NFCU's two Confiscation Orders, with the FSA receiving a small percentage of funds obtained. So far, in excess of £4000 is expected to be received from successful orders.

- supported a partner agency in connection with a court trial in Northern Ireland which is due to commence in January 2024.

3.11 The Food Fraud Resilience Tool (alongside website takedowns for DNP and Mineral Miracle Solutions) forms a key part of the non-pursue strategy for fighting food crime. It has been completed over 650 times since its launch in 2021, with 129 completions as of September 2023. This surpassed the 122 completions in 2022. There was a peak in completions following the media coverage of Operation HAWK earlier this year. The NFCU will continue to assess the format and impact of the tool.

4. Progress Against the External Review Recommendations

4.1 The NFCU has made good progress against the five external review recommendations, detailed below. The progress below has been achieved within existing resourcing allocations.

Recommendation 1 - Clearer definition of the Unit’s purpose, with performance indicators aligned to its strategy.

4.2 A new NFCU mission statement was agreed, clarifying the importance of balancing prevent and pursue activities. New KPIs were also agreed to enhance the NFCU's focus on our strategic objectives, detailed in Annex C.

Recommendation 2 - Using this enhanced clarity, provided by recommendation 1, to assess ‘as-is’ capability and then design and build the required ‘to-be’ position.

4.3 Two priority capability areas have been agreed. The first focusses on enhancing the NFCU's Digital Forensics capabilities to replace existing services provided by Defra and the second focusses on enhancing its capability to prevent food crime. These priority areas are being delivered within existing resources and through adjusting NFCU organisation structure.

Recommendation 3 - Ensuring access to the latest tradecraft and capability within law enforcement to enhance capabilities.

4.4 The NFCU has secured support from expert law enforcement agencies to enhance our tradecraft and capabilities. This has included the College of Policing and the National Police Chiefs' Council lead for Serious and Organised Crime.

4.5 The NFCU also has the ability to engage with Federated Tasking Teams, through the Government Agency Intelligence Network (GAIN). This enhances our access to specialist capabilities, arbitration for risk transfer and the provision of external operational review.

Recommendation 4 - Nurturing of internal culture and improvements to internal career pathways.

4.6 During 2023, seven staff members achieved certification under the Intelligence Professionalisation Programme (IPP) (footnote 4), bringing the total to nine. The number of staff undertaking Counter Fraud accreditation also increased this year, ensuring that investigations are led by appropriately qualified and experienced staff.

4.7 There has been increased NFCU engagement with Field Operations teams. NFCU staff attended Regional Engagement and Development days, promoting food crime priorities and reiterating how front-line staff can share information.

4.8 Similarly, there has been increased NFCU engagement with the Incidents and Resilience Unit. This has been through direct involvement with both routine and non-routine incidents, as well as co-ordinating efforts on prevention strategies.

4.9 The NFCU plans to jointly deliver a scenario-based development exercise to explore how to improve collective working during a food crime investigation.

Recommendation 5 - Better projection of the Unit, its food crime messaging and its successes.

4.10 The NFCU has devised a new stakeholder engagement plan that aims to enhance communications with all key NFCU stakeholders.

4.11 The FSA has become more proactive in relation to both its mainstream media and social media communications to promote food crime work. This included coverage of the NFCU investigation into DNP supply, Operation ATLAS, featuring on the BBC documentary The Defenders.

5. Progress against KPIs and Review actions

5.1 Of the 31 tasks linked to the Review AFIs, identified as part of the NFCU's review response, many of which are addressed by the activity referenced in section 4, 24 are on track for completion this year. The remaining seven are to be initiated this year as part of longer pieces of work. The NFCU will continue addressing many aspects of the review recommendations into the new 2024/25 performance year, in line with the priorities summarised in section 10.

5.2 The NFCU is making positive progress on its new KPIs, outlined in Annex C. These KPIs aim to quantify the NFCU's recorded impact against food crime and how our understanding of the food crime threat has improved. Where possible, data relating to the new KPIs has been presented for the calendar year to end September for the purposes of this annual update.

- Three new KPIs seek to enhance the NFCU's recorded impact against food crime. The first focuses on the number of operations that close with a recorded impact. The NFCU is on track to achieve this target, with 51% of operations closing in so far in the 2023-24 calendar year having a recorded Disruption or Outcome.

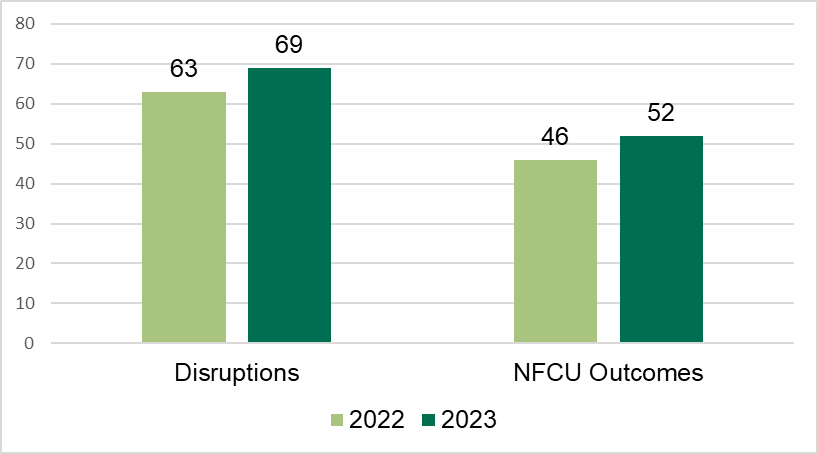

- The second and third impact-related KPIs concern the increase in the number of National Disruptions (footnote 5) registered with the National Crime Agency, as well as NFCU Outcomes (footnote 6). Figure 1 shows an uptick in these figures in the first three quarters of the calendar year. Annex B provides further breakdowns by 4P and linked Control Strategy priority. Continuing efforts towards achieving impactful results remains a priority for 2024.

Figure 1: 2022/2023 Disruptions and Outcomes Comparison

The final KPI concerns the enhancement of our understanding of the food crime threat through the fulfilment of our Strategic Intelligence Requirements (SIRs), which are intelligence gaps identified relating to our Control Strategy priorities. For example, under the Beef priority theme, we are working to answer the SIR: 'How is the abuse of the animal ID system allowing fraudulent product to enter the food chain?'. Improvements are tracked through a RAG rating system, updated every eight weeks. 24% of these RAG ratings improved in the first two quarters of the financial year, signalling that the NFCU is on course to achieve its target of 40% improvement ratings by Q4 of the 23/24 financial year.

6. Food Crime in the Public Eye

6.1 The significance of the ten-year anniversary of the detection of horsemeat in beef products has meant there has been a substantial focus on the issue of food crime in public and media discourse. This has included positive reflections on many of the developments which followed the Elliott Review, such as the Food Authenticity Network, the Food Industry Intelligence Network and establishing the NFCU.

6.2 In March/April 2023, there was intense media activity around an NFCU investigation into country-of-origin misrepresentation of meat products. This resulted in scrutiny of the actions of regulators and industry with regards to tackling food fraud. The FSA responded through the establishment of a working group, with industry, to address three key areas. These were the provision and visibility of reporting routes for people such as whistleblowers, information flows from Third Party Assurance schemes and improvements to the format, content, timeliness and distribution of intelligence-based alerts to industry from NFCU.

6.3 The progress made on all of these themes, by FSA and industry partners, was shared in a further message in October 2023, and has included:

- a new freephone number for the NFCU's Food Crime Confidential hotline.

- positive developments around information exchange with Third Party Assurance schemes.

- improvements to NFCU processes for issuing alerts.

6.4 There remains outstanding aspects of activity agreed in the Working Group to be operationalised. The NFCU is currently refining an alert Standard Operating Procedure to ensure alerts are issued in a consistent manner without jeopardising the integrity of ongoing investigations. We will also continue to engage with stakeholders to monitor the effectiveness of the revised process and its ability to meet the agreed Working Group objectives. Alongside this work, an impact assessment will inform decisions to issue an alert. The development of publicity material to encourage reporting in food businesses is also planned. It is expected that activities will conclude by March 2024. Discussions continue around further work with voluntary Third-Party Assurance schemes.

6.5 The NFCU investigation, which prompted this collective response, remains a live investigation with large volumes of digital material being reviewed. In July 2023, the NFCU undertook intelligence-instigated operational activity with partners. After completing NFCU-led training, Trading Standards officers conducted visits at five businesses supported by NFCU officers. An unregistered business was found operating without any food safety management system. All food on the premises was detained and later disposed of, including several tonnes of meat. The business operation was also closed down.

7. Developing Capabilities

7.1 The FSA is on track to propose to the Secretary of State for Health and Social Care that they lay two Statutory Instruments in early 2024. These will secure access to further investigation powers, mainly under the Police and Criminal Evidence (PACE) Act 1984 and bring food crime officers the complaint handling regime of the Independent Office for Police Conduct (IOPC).

7.2 The NFCU has secured agreement in principle, for an interim voluntary inspection arrangement with His Majesty's Inspectorate for Constabulary, Fire & Rescue Services (HMICFRS). This awaits Ministerial approval from the Home Office.

7.3 Financial investigation powers have been enhanced by the Economic Crime Corporate Transparency Act 2023 granting additional powers of seizure, under Section 47 of the Proceeds of Crime Act 2002, to NFCU financial investigators.

7.4 On 6 October 2023, His Majesty’s Attorney General signed an assignment that now formally permits the Crown Prosecution Service to both advise on and prosecute NFCU cases. Prior to this assignment, the CPS had been agreeing to this on a case-by-case exemption basis, something NFCU and FSA Legal colleagues have been seeking to rectify for a number of years.

7.5 The NFCU also commenced identifying and mapping organised crime groups (OCGs). Two groups have already been mapped, with work starting on a third. The NFCU's mapping will contribute to the wider national law enforcement dataset that will enable a holistic approach to dismantling OCGs.

7.6 The FSA commissioned external research, entitled 'What works to prevent Food Fraud', which was published in October 2023. The report identifies a requirement for further emphasis on food fraud prevention, coordinated between public and private stakeholders, raising awareness and competence in the delivery of food fraud prevention activity. Some recommendations are already addressed as part of ongoing work. Work has begun on the common principles for a coordinated FSA-wide approach to prevention.

8. NFCU Governance Arrangements

8.1 In order to efficiently manage resources and maximise the impact on food crime, the NFCU has in place a tasking and coordination process, and defined thresholds for progressing investigations. Both aspects are informed by national law enforcement frameworks and enable the NFCU to have a consistent, proportionate and evaluated response to food crime.

8.2 The NFCU's tasking and coordination process is based on the College of Policing's Authorised Professional Practice (APP) which is informed by the National Intelligence Model. The 2022 external review included NFCU tasking and coordination within its remit but did not identify areas for improvement.

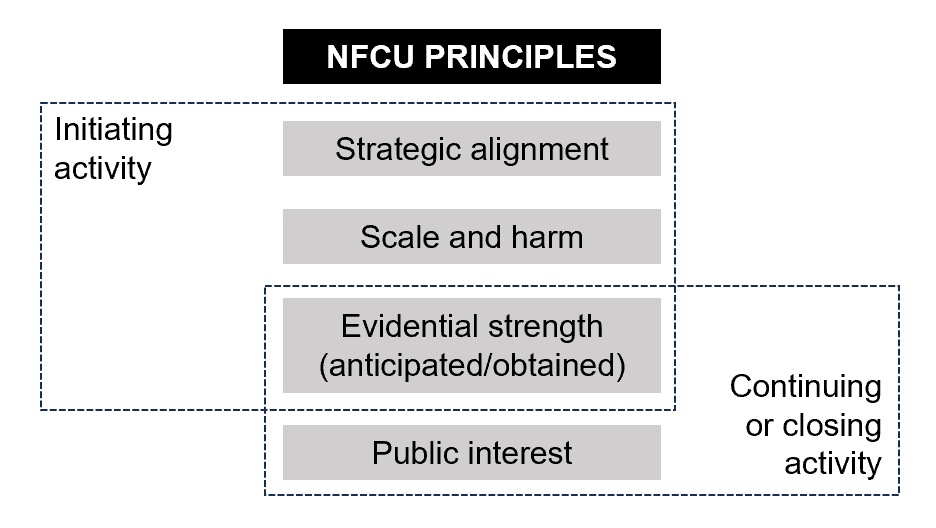

8.3 The NFCU approach to investigations is guided by the following principles:

- Strategic alignment - we should consider whether the intelligence is linked with a Control Strategy priority.

- Scale and harm - we should consider the potential geographical scope and scale of the suspected offending. We will also consider the nature and extent of the actual, potential or intended harm to either the public, the food business operator or the reputation of the UK food industry.

- Evidential strength - we should be sure there is enough reliable and credible evidence, or that securing this is a foreseeable reality, to provide a "realistic prospect of conviction" and enable the CPS to prosecute.

- Public interest - we should verify it is in the public interest to bring a case to court. This is informed by the cost of continuing enquiries and the length of time that will take, as well as other investigative priorities.

8.4 Figure 2 shows how the principles are applied at different stages.

Figure 2: The Application of NFCU Principles

8.5 The agreed remit and threshold definition can be found in Annex D.

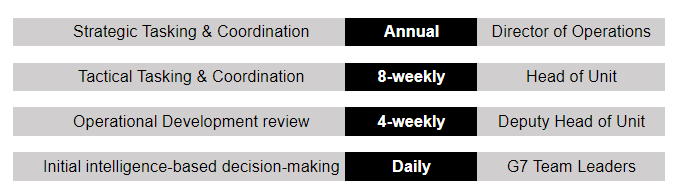

8.6 Operational tasking and prioritisation happens at several levels, with decision-makers, as set out in Figure 3. These include:

- annual, thematic priority-setting at Strategic Tasking and Coordination, endorsed by the Director of Operations.

- tactical decision-making around emerging issues or existing taskings every eight weeks.

- more frequent review of intelligence development activity at four-weekly Operational Development Groups.

- consistent initial decision-making on incoming intelligence, informed by partners from RCD and the Incidents Unit, three times each week.

Figure 3: Summary of the Tasking and Coordination Process

8.7 The output from Tactical Tasking and Coordination is shared with the Director of Operations, who also receives quarterly investigation updates and regular briefings from the Head of the NFCU on operational matters.

8.8 Where an NFCU operational issue has food safety implications, major reputational risks or other ramifications for the broader responsibilities of the FSA, the Incident Management Plan can be implemented. FSA plans for both Routine and Non-Routine incident management allow for food crime to be addressed within this framework, with further escalation and strategic oversight as required.

9. Forward Look – Challenges and Opportunities

9.1 Looking ahead identifies challenges and opportunities in communicating and better understanding the food crime threat. These are also present in how we can develop internal capabilities and improve delivery. Progressing investigations, achieving more impactful results against food crime and delivering more of the response to the 2022 review will remain the key focus.

The Threat Picture

9.2 The publication of an updated Food Crime Strategic Assessment, compiled in partnership with the Scottish Food Crime and Incidents Unit, is planned for spring 2024, and will provide an opportunity to further enhance and communicate our understanding of the food crime landscape to stakeholders.

9.3 The NFCU is tracking developments related to the Border Target Operating Model (BTOM) and the Windsor Framework, key programmes relating to the current or future landscape around movements of food and feed and associated checks, data capture and risk awareness. The NFCU has already worked with FSA colleagues and Food Standards Scotland to explore the potential impacts of any new requirements and continues to engage with colleagues around BTOM and the Accredited Trusted Trader Scheme (TTS).

Maintaining and Building Capabilities

9.4 A fit-for-purpose, affordable digital forensics capability for NFCU investigators is a high priority. The NFCU's existing provider will not be continuing to provide this service. Workload is being prioritised in preparation for the coming loss of service and alternatives within the private sector and government departments are being urgently pursued. Resolving this situation is a priority for 2024, alongside budgeting for this requirement.

9.5 The NFCU will focus delivering enhanced performance within existing staffing and resourcing and will be keen to maintain headcount after a year in which staff attrition has presented challenges. In 2023 this required the use of overtime to maintain operational delivery as well as impacting the timeliness of case file preparation, although no deadlines have been missed. The causes of staff movements have been reviewed and have not presented concerns requiring corrective action. Staff often moved on promotion or for higher pay elsewhere.

9.6 The NFCU is on track to record more impactful disruptions and outcomes against food crime. However, we recognise the wider challenges within the Civil Service landscape and need for enhanced efforts to demonstrate value for money.

10. Conclusions

10.1 The NFCU's key priorities for the year ahead will be to:

- progress investigations towards judicial outcomes.

- enact agreed responses to the external review recommendations and continue to progress Areas For Improvement included in the NFCU business plan.

- improve our outwards facing communication and embed the outcomes from the Industry Food Fraud Working Group into business as usual.

- recruit and retain NFCU staffing levels to our full established headcount.

- secure a sustainable alternative for NFCU's digital forensic capabilities.

- deliver an updated Food Crime Strategic Assessment in Spring 2024.

- continue progression towards securing additional powers.

- continue efforts towards achieving greater impact against food crime, recording more disruptions and closing more operations with an outcome.

- assist in progressing work with the wider FSA on a holistic prevention approach.

Annexes

12. Annex A - Summary of Cases Awaiting Trial

- Trial 1 – concerns the long-term illegal diversion of animal by-product into the human food chain This trial commenced in July 2023, but was stopped after a week when one of the defendants took ill. As a result, the trial was adjourned until 15th January 2024 at the Inner London Crown Court.

- Trial 2 – concerns the illegal diversion of animal by-product. This case is next for hearing in April 2024.

- Trial 3 – concerns a European distribution fraud involving the theft of food items to an estimated value of £520,000. The trial date is fixed for July 2024.

- Trial 4 – concerns an employee of a Food Business Operator allegedly delaying NFCU officers’ access to the Food Business premises, whilst the NFCU were seeking to conduct an unannounced inspection. The suspect is due to appear in court in March 2024.

13. Annex B - National Disruptions and NFCU Outcomes

Table 2: 2023 Disruptions and Outcomes by 4P Approach

|

4P Type |

National Disruptions |

NFCU Outcomes |

|---|---|---|

|

Prevent |

39 |

17 |

|

Pursue |

15 |

11 |

|

Protect |

13 |

11 |

|

Prepare |

2 |

13 |

Table 3: 2023 Disruptions and Outcomes by Control Strategy Theme

|

Control Strategy Theme |

National Disruptions |

NFCU Outcomes |

|---|---|---|

|

All Red Meat themes |

21 |

18 |

|

Dangerous Non-foods |

29 |

1 |

|

Diversion of ABP |

8 |

3 |

|

Chicken |

2 |

1 |

|

Shellfish |

0 |

4 |

|

Out of Control Strategy |

9 |

25 |

14. Annex C - New KPIs

Table 1: New KPI Descriptions

|

KPI Number |

KPI Description |

|---|---|

|

1 |

50% of closed NFCU operations (footnote 7) to have achieved a recorded National Disruption with the National Crime Agency or a NFCU Outcome. |

|

2 |

Increase the Unit's demonstrable impact on serious food crime by achieving 55 National Disruptions, recorded with the National Crime Agency. |

|

3 |

Develop food crime capability, deter food criminality and/or improve protection from food crime by achieving 50 NFCU Outcomes. |

|

4 |

Improved understanding to be achieved on 40% of the NFCU’s identified Strategic Intelligence Requirements (SIRs). |

15. Annex D - Governance

NFCU Remit and Definition

This definition was last reviewed and ratified in October 2023, following a consultation with the Association of Chief Trading Standards Officers and National Trading Standards Board.

"The NFCU has the remit within the Food Standards Agency for tackling serious fraud and related criminality (footnote 8) within food supply chains. It will normally investigate offences appropriate for prosecution under the Fraud Act 2006 or as conspiracy to defraud under Common Law. The Unit covers England, Wales and Northern Ireland, but not Scotland.

The NFCU will lead on the most serious and complex investigations each year and will have some capacity to coordinate and support investigations led by partners.

In deciding whether to lead, coordinate or support an investigation the Chair of Tasking will consider whether the complexity and nature of the suspected offence warrants the application of the NFCU’s specialist skills, expertise, and capabilities.”

-

More details on the 4P Approach.

-

DNP is a highly toxic substance often marketed as a fat burner.

-

Operations include tasked investigations and intelligence developments.

-

IPP is a professional standard, outlined by the College of Policing, and demonstrates operational competence.

-

A national disruption is defined by the National Crime Agency as "when an agency takes action in response to a threat which has an impact against it".

-

An National Food Crime Unit outcome is defined by the National Food Crime Unit as "any action led, supported or co-ordinated by the National Food Crime Unit that falls short of a national disruption but still: develops capacity, deters potential offenders or improves awareness.

-

Operations include intelligence development, partner coordination or investigations.

-

Related criminality refers to offences linked to a suspected fraudulent pattern of conduct such as money laundering offences, regulatory offences or other offences deemed appropriate by the tasking chairs of the NFCU and in line with the advice of prosecutors.

Revision log

Published: 29 November 2023

Last updated: 10 December 2024